The combination of the COVID-19 pandemic, the spreading of protectionism from trade to finance and technology and socio-political disturbances across major and emerging economies has added up to a perfect storm for the global economy

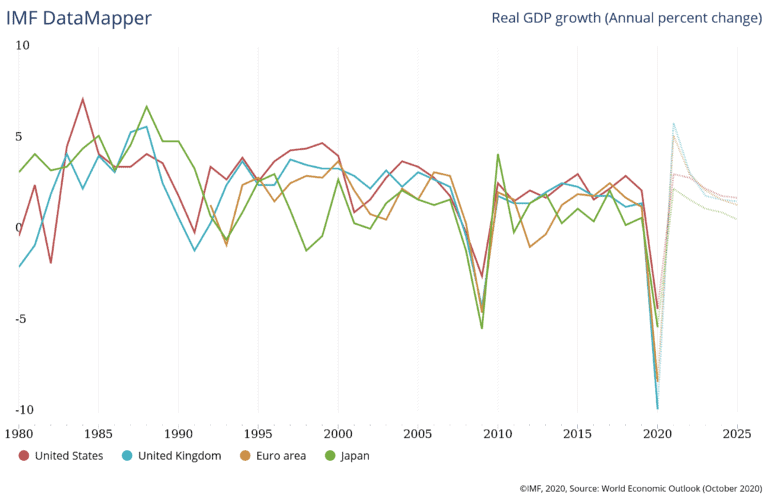

Developed economies: worst recession since Great Depression

The extensive and prolonged shutdowns of country borders and business activities as a result of the full or partial lockdown measures are expected to send all developed economies into the worst recession since the Great Depression of the 1930s, characterised by an unprecedented blow from both the supply and demand side to businesses which are facing supply chains shock on the one hand and pandemic-driven fragility on the other. The International Monetary Fund (IMF) is forecasting a contraction of 8% in the developed economies in 2020, particularly severe for the EU. The IMF expects the US, with one of the highest numbers of confirmed COVID-19 cases in the world, to see its economy plummet by 4.3% in 2020. Adding to the economic storm is the America First policy that continued to fuel Sino–US economic con conflicts and transatlantic trade tensions, resulting in a 13.2% year-on-year drop in US merchandise trade during the first eight months of 2020.

Despite early lockdown easing starting June 2020, the EU economy is not expected to see a fast rebound as global supply chains, especially for the automobile and extractive industries, and consumer demand, both local and external, are still far from normal. Crippled by other risk factors such as Brexit, the IMF is projecting the Euro zone economies to plunge by as much as 8.3% in 2020, to be followed by a recovery of 5.2% in 2021. Meanwhile, the UK is likely to suffer serious damage from the coronavirus crisis, bracing for a 9.8% economic slump in 2020 and a 5.9% rebound in 2021.

Japan suffered a double whammy of COVID-19 and a consumer recession triggered by the VAT (value added tax)- hike in October 2019. The economy has recorded declines for three consecutive quarters since the fourth quarter of 2019 and is expected to dip by 5.3% in 2020 as a whole, before a lukewarm 2.3% recovery in 2021.

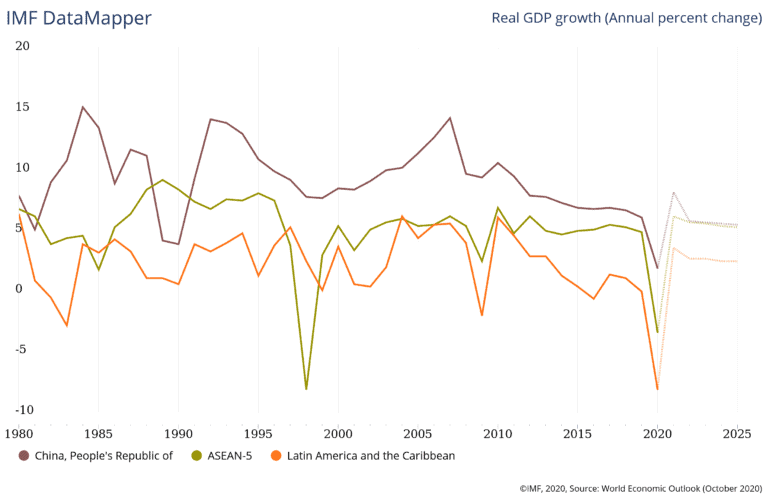

Emerging economies: diverse performances

Despite a more upbeat outlook since the second quarter of 2020, commodity markets are still far from a sustained recovery as containment measures continue to deny a full resumption of economic activity. Unassuming energy and commodity prices lend little support to export-led economies. Countries with strong manufacturing sectors such as Mexico and Turkey could face stress from supply chain disruption. However, given relatively effective virus containment measures and substantial policy stimulus, Mainland China and many East Asian economies are expected to recover earlier and stronger than most other economies.

In Mainland China, exports performance is expected to remain weak and domestic demand will be the main driver of growth. Economic activity has been normalising since the gradual relaxation of lockdowns, with major output and consumption indicators picking up. The IMF is projecting a positive 1.9% GDP growth for 2020 and a major rebound of 8.2% in 2021.

Growth in ASEAN is expected to stall in light of the pandemic, but is expected to rebound in 2021 with effective containment measures and substantial policy stimulus. In November 2020, the Regional Comprehensive Economic Partnership (RCEP) was signed by the 10 members of ASEAN, South Korea, Mainland China, Japan, Australia and New Zealand. As the world’s largest free trade agreement, it covers a market of 2.2 billion people (almost 30% of the world’s population) with a combined GDP of US$26.2trn (about 30% of the global GDP). The RCEP is expected to eliminate a range of tariffs on imports within 20 years. It delivers a single set of rules covering all 15 markets, making trade simpler and creating opportunities for exporters to get their products and services into regional value chains.

Along with the slowest economic growth since 1980 with a 2% CAGR in the past five years, Latin America has become the new “red zone” for COVID-19. The IMF sees the region posting an 8.1% recession in 2020, the worst among emerging economies, to be followed by a mild recovery of 3.6% in 2021.

What is RCEP?

The RCEP delivers a single set of rules covering 15 markets, making trade simpler and creating opportunities for exporters to get their products and services into regional value chains

Supply chain restructuring, trade protectionism and geopolitical tensions

Concerns over COVID-19-related contagions and global supply chain disruptions, as well as rising trade protectionism, have prompted some companies to reconsider their sourcing arrangements, including diversifying their manufacturing facilities from Mainland China to their home countries, a policy championed by a number of governments, notably the US and Japan. While any significant restructuring of the global supply chain is unlikely in the near term, pressure to diversify sourcing could add to uncertainties in trade performance.

Rising protectionism remains a major threat to the world economy as well as Hong Kong’s exports amid the current global health and economic crisis. Despite the signing of the Phase One Trade Agreement in January 2020, the already complicated Sino–US relations have sunk to a new low amid tensions around the pandemic, technology and human rights.

Tensions on the Korean Peninsula, Taiwan Straits and the South China Sea remain a concern, given US efforts to pursue its Indo–Pacific containment strategy against Mainland China. In the Middle East, oil prices recover as the OPEC+, led by Saudi Arabia and Russia, agree to continue supply limits. However, any disagreement within the uneasy alliance will add uncertainty to oil price movement and the economies in the region.

Evolving consumption and business patterns

E-commerce continues to revolutionise the retail landscape as online marketplaces and omni-channel business models are proven to be pandemic-resilient. The wider adoption of smart solutions empowered by disruptive, AI- or data-driven technologies continues to reshape the future of marketing and shopping, while pampering consumers with new buying experiences, fulfillment options and payment methods.

The pandemic has not only accelerated the deployment of 5G and Wi-Fi 6 technologies, but further enabled the implementation of blended, online-to-of ine (O2O) business models

characterised by the wider use of chatbots, cloud computing, AI and machine learning. As far as trade and manufacturing are concerned, the greater accessibility of cloudbased technologies and solutions involving Internet of Things (IoT), big data analytics, 3D printing, blockchains and real-time management solutions are poised to enhance not only efficiency, but resilience of global production and logistics post-crisis.

Mainland China’s economic initiatives

In response to the new global environment, Mainland China is adopting a new development model of “dual circulation” with domestic demand as the main growth driver, to be reinforced by external demand and resources. New infrastructure development will be one of the keys in promoting high-quality growth, focusing on areas such as 5G networks, inter-city transportation and inner-city rail systems, data centres, artificial intelligence, etc.

Mainland China’s outbound investment in Belt and Road countries and regions continued to increase, accounting for 13.6% of the country’s total outbound direct investment in 2019. Trade along those continues to grow as well with a rise of 6% in 2019 to exceed US$1.3trn, accounting for 29.4% of Mainland China’s total trade, up by 2%t points from 2018. Between January and August 2020, Chinese companies’ direct investment in non- financial sectors of 54 countries and regions along the Belt and Road went up by 31.5% year-on-year. Top investment destinations include ASEAN, the UAE and Kazakhstan.

Strengthening Hong Kong as a business hub

The Free Trade Agreement (FTA) and Investment Agreement (IA) between Hong Kong and ASEAN have partially commenced since June 2019. As of October 2020, the parts relating to Laos, Myanmar, Singapore, Thailand, Vietnam, Malaysia, the Philippines, Indonesia and Brunei Darussalam have taken effect, except for Cambodia. In addition, the FTA and IA between Hong Kong and Australia have also entered into force in January 2020. These allow Hong Kong firms to gain enhanced market access to ASEAN and Australia, facilitating investment flows with the two regions and sustaining the city’s position as a world business hub.