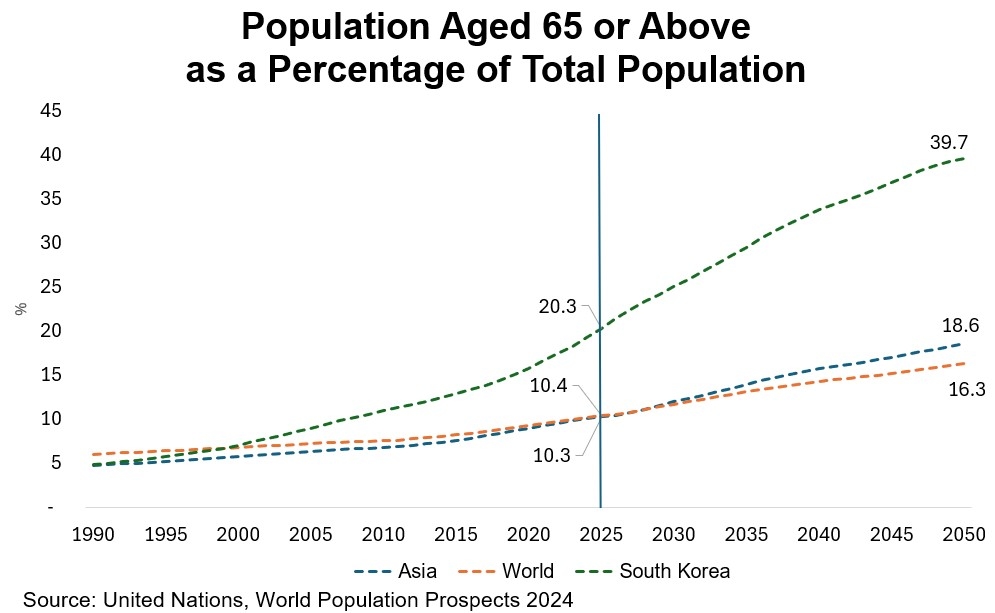

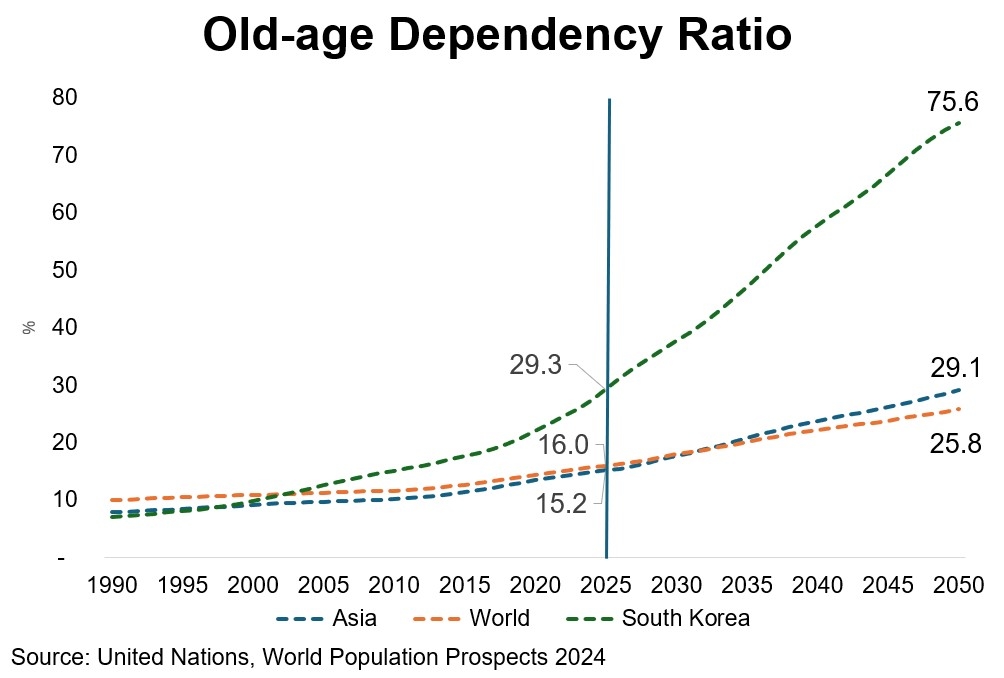

East Asia is ageing faster than any other region, and by 2050, Hong Kong, South Korea, Taiwan, and Japan will have the world’s oldest populations according to the United Nations. South Korea in particular is seeing its population aged 65 and above rise from 20% in 2025 to nearly 40% by 2050. This demographic shift is reshaping its workforce, economy, and healthcare system—while also creating new opportunities in the “silver economy,” the market serving older adults.

As there is an increasing focus on addressing the needs of an older population, as well as the potential business benefits this may bring, we will explore ways to leverage this silver economy with reference to South Korea’s ageing population.

Learn More:

Key Features of South Korea’s Ageing Population

From 1990 to 2024, South Korea’s senior population more than tripled, while total population growth stagnated. The old‑age dependency ratio is projected to reach 75.6% by 2050, meaning far fewer workers supporting each retiree.

High Labour Market Participation Among Seniors

Many seniors keep working: in 2023, 37.3% of those over 65 remained employed—the highest rate in the Organisation for Economic Co-operation and Development (OECD) countries—often due to low pensions rather than choice. Pension payouts in 2022 were well below the basic living cost, highlighting financial insecurity among the elderly.

Challenges in Healthcare & Social Support

Healthcare presents another challenge. With 84% of seniors managing chronic illnesses and 15% homebound, the nation faces doctor shortages, especially in rural regions. Meanwhile, more seniors are living alone—single‑elderly households are expected to reach 5 million by 2052—intensifying the need for accessible care and social support.

The Government’s Approaches to Addressing an Ageing Society

To address these pressures, the South Korea government’s Basic Plan for an Ageing Society and Population (2021–2025) aims to build a healthier, more active ageing population. Reforms include:

- Raising the minimum retirement age to 60+

- Creating senior employment programs

- Expanding long‑term care insurance

- Reinforcing dementia prevention initiatives

- Pension reforms passed to stabilise the system to 2071.

Senior Living: What This Means for Global Buyers & Suppliers

Despite challenges, the ageing trend is driving growth in innovation, biotech, assistive devices, and AI-powered healthcare solutions. Technologies such as wearable health monitors, companion robots, and smart home aids are being rapidly adopted to enhance daily living.

Older consumers—healthier, wealthier, and more independent—are fueling markets in travel, wellness, and active lifestyle products. However, strict healthcare regulations and product reimbursement rules remain major entry barriers. Companies aiming to serve South Korea’s silver economy must navigate these regulatory frameworks carefully to succeed.

Explore Full Findings

Access detailed insights from HKTDC Research via:

Source Safe and Senior-Friendly Products on hktdc.com Sourcing

Given the enormous growth in ageing populations across Asia (and globally), it is time to tap into the silver market with the right platform. With our trusted e-Marketplace, you can easily find ideal healthcare and lifestyle products that fit the need of worldwide seniors.

Start your exploration today: