The transformation of toys from simple childhood playthings into sophisticated business ecosystems represents one of the most remarkable shifts in modern retail. What began as wooden blocks and tin soldiers has evolved into a $288.34 billion global collectibles market, projected to reach $489.48 billion by 2033—with adults now driving the majority of this unprecedented growth. The global toy collectibles segment alone has expanded from $12.5 billion in 2023 to a projected $20.3 billion by 2032, representing a robust 5.7% CAGR that outpaces many traditional retail categories. This isn’t merely market expansion—it’s the emergence of entirely new orchestrated ecosystems that connect creators, collectors, technology platforms, and communities in increasingly sophisticated ways.

The Great Evolution: From Corner Stores to Orchestrated Experiences

The journey from traditional toy retail to today’s orchestrated collectibles ecosystem reflects broader changes in how consumers discover, purchase, and engage with products. The evolution began with department stores in the early 20th century, where toys occupied small corners alongside household goods. The 1980s introduced specialty toy retailers, creating dedicated spaces for play and discovery that fundamentally changed how families interacted with toys.

Today’s model is truly orchestrated by the complementary interplay between trade shows and digital platforms: international toy fairs draw tens of thousands of global visitors for discovery, relationship building, and exclusive debuts, while digital channels enable year-round engagement, real-time authentication, and global trading networks. Trade shows spark buzz and exclusive product drops that drive online engagement, and digital communities, in turn, fuel anticipation for physical events—creating a symbiotic ecosystem in which both fairs and platforms thrive.

The Numbers Behind the Transformation: Data-Driven Growth

The scale of this transformation becomes clear through recent market data. Adults (18+) now represent the fastest-growing demographic in toy purchases, with Q1 2025 spending reaching $1.8 billion—a 12% increase year-over-year. This “kidult” phenomenon now accounts for 28-34% of global toy sales, fundamentally reshaping industry priorities. For the first time in history, adult toy purchases have surpassed preschooler segment sales, with 43% of adults purchasing toys for themselves in the past year.

The investment dimension has added unprecedented legitimacy to collecting. Trading cards exemplify this shift: the global market reached $15.8 billion in 2024 and is projected to hit $23.5 billion by 2030 (CAGR 6.5%). Professional grading services have formalized the investment culture, with graded collectible cards selling for 5-100x their ungraded value. This has created sophisticated secondary markets where collectors view purchases as both passion and portfolio diversification.

Regional patterns reveal Asia-Pacific’s dominance, representing 36.48% of global toy market value. China’s collectible market specifically expects 35% annual growth, driven by blind box culture and digital integration that appeals to tech-savvy younger consumers. The broader Asia-Pacific collectibles market is growing at 6.4% CAGR—the fastest globally—fueled by rising disposable incomes and cultural heritage appreciation.

Four Pillars of the Orchestrated Collectibles Economy

This orchestrated ecosystem revolves around four core categories, each requiring different approaches to community building, scarcity management, and value creation:

Trading Cards: The Investment Playground

Trading cards represent perhaps the most sophisticated orchestration of scarcity, community, and investment psychology. The global trading cards market reached $15.8 billion in 2024, with adult collectors driving premium product demand. Professional grading services like Professional Sports Authenticator (PSA) and Certified Guaranty Company (CGC) have formalized investment culture, creating transparent value systems that legitimize collecting as asset allocation.

Innovation continues through “breakers” (collectors who open sealed products live on camera for audiences) and live unboxing experiences that blend entertainment with commerce, creating new distribution channels that appeal to social media-savvy collectors. Cross-category expansion beyond traditional sports into franchises like Disney Lorcana and One Piece demonstrates the format’s versatility, with Pokemon alone seeing 19% adult participation rates. Digital integration through NFTs and blockchain authentication creates hybrid physical-digital experiences that satisfy both traditional collectors and tech-forward enthusiasts.

Building Sets: Engineering Community Connections

The global building sets market’s 11.8% CAGR growth is primarily fueled by adult collectors seeking complex, themed sets that transcend children’s play. Premium positioning has proven highly successful, with LEGO Icons sets like the $850 Millennium Falcon demonstrating how sophisticated designs command superior pricing among adult collectors. LEGO’s adult-focused lines contributed to a 12% sales jump in 2024, driven primarily by adult fans.

This category uniquely orchestrates multiple value propositions: parents purchase for children’s STEM education while adults collect for display and nostalgia. AR integration and customizable kits foster active communities where builders share creations, modifications, and collecting strategies, creating ongoing engagement beyond purchase. The emotional connection to construction and problem-solving appeals to demographics seeking both intellectual stimulation and stress relief.

Collectible Figures: Where Passion Meets Investment

The collectible figures market, growing at 5.7% CAGR, benefits from 30%+ adult market share driving premium purchases. Major intellectual properties like Funko Pop!, Marvel, and Star Wars create “addictive collecting loops” through limited editions and authenticated collectibles that command premium prices. The blind box phenomenon, exemplified by brands like Pop Mart, has turned figure collecting into high-stakes gaming where mystery fuels repeated purchases.

Digital enhancement through AR-enabled figures and NFT integration appeals to tech-savvy buyers, while established platforms like eBay and StockX enable global trading networks. Professional authentication services and blockchain integration address counterfeit risks while formalizing collectibles as legitimate assets, with some rare figures appreciating 500%+ over decades. The dopamine-driven psychology of collecting triggers the same reward mechanisms associated with gambling and gaming, creating highly engaged customer bases.

Licensed Premium Products: The IP Advantage

Licensed toys represent 34% of the U.S. toy market in 2024, demonstrating intellectual property’s essential role in driving sales. Adult collectors generate significant market share through licensed merchandise, creating nostalgia-driven growth flywheels that benefit both original IP holders and manufacturers. High-end licensed products command superior margins while building brand loyalty across generations, with successful franchises creating decades-long collecting journeys. Collectible toy sales grew nearly 5% globally in 2024, fueled by trading card games, small collectible figures, and plush toys.

The New Collector Psychology: Three Archetypes Driving Growth

Research reveals three distinct collector archetypes whose spending power and behavioral patterns drive this orchestrated ecosystem:

The Enthusiast: The Market Powerhouse (Ages 30-45, Digitally Savvy)

The Enthusiast collector collects 6+ toy types with sophisticated approaches to exclusivity, grading, and investment potential. Market research shows these collectors generate disproportionate revenue impact through premium purchases, with average annual spending exceeding $4,800—and top enthusiasts investing $50,000+ annually across multiple categories. Their demand for professional authentication and grading services has elevated entire market segments from hobbyist pursuits to legitimate investment categories.

Market Impact: Enthusiasts represent only 15-20% of collectors but generate 40-45% of total market revenue, making them the primary driver of premium product development and market legitimization. They validate new categories, drive early adoption of emerging technologies, and set pricing benchmarks through their willingness to pay premiums for quality and rarity.

Engagement Strategies: Offer VIP early entry, guaranteed grading slots, and first-access drops at fairs, plus dedicated online forums and exclusive digital previews to sustain their intense interest and reward their loyalty.

The Casual: The Community Amplifier (Ages 25-40, Socially Active)

The Casual collector pursues 4-5 types while creating content that documents their collecting journey. Research indicates they transform collecting from private hobby to public entertainment, generating millions of views through unboxing videos and collection showcases, driving mainstream awareness and trend adoption beyond traditional collector circles. Their influence extends far beyond personal purchases to shaping broader cultural perceptions of adult collecting.

Market Impact: While individual spending averages $2,000-3,000 annually, their collective influence expands market reach by 300-400%, making them essential for category growth and mainstream adoption. Female participation in this segment has grown 40% since 2022, driven by platforms like TikTok and Instagram that reward visual collecting content. They represent the bridge between niche collecting communities and mainstream consumer awareness.

Engagement Strategies: Host live unboxing events and social media challenges, provide shareable digital badges and influencer partnerships, and maintain active online communities to capitalize on their content-driven engagement.

The Selective: The Heritage Investor (Ages 35-50, Memory-Driven)

Representing the financially stable demographic, The Selective collects 2-3 types focused on childhood memories and emotional connections. Academic research reveals their motivation centers on “material fandom” and generational media experiences that shaped their formative years. They willingly pay premiums for authentic childhood connections, driving demand for reissues and vintage items that trigger powerful emotional responses.

Market Impact: Selectives drive 60% of licensed product sales and represent the most brand-loyal segment, with collecting relationships lasting 15-20 years on average—crucial for sustained category health. Their purchasing patterns focus on higher-value individual pieces rather than volume collecting, with average annual expenditure of $3,000-4,000. They often introduce children to the same properties, creating generational continuity that benefits long-term brand value.

Engagement Strategies: Offer curated nostalgia showcases, memory-lane guided tours at fairs, specialized authentication certificates, and heritage content series—both in-person and via dedicated digital channels—to honor their emotional investment.

Demographic Evolution: The Expanding Collector Universe

The average collector age of 36.7 years, with female engagement rising from 28% in 2020 to 45% today, reflects broader cultural shifts in adult collecting. This growth stems from increased financial independence, visual social platforms, and acceptance of collecting as both hobby and investment.

Consequently, this expanding demographic has driven new product categories—from designer plush to aesthetic figurines—and fostered community dynamics focused on display, photography, and emotional connection. Moreover, women now generate 60% more social media engagement around collecting, fueling viral marketing and signaling a more diverse, culturally sophisticated market ripe for multi-touchpoint orchestration.

Global Market Leadership and Diversification

China’s Manufacturing and Market Dominance

China dominates the global collectibles supply chain, accounting for over 80% of worldwide toy exports ($48.36 billion in 2022) through more than 10,000 manufacturers employing 6 million workers. This massive scale creates unmatched production capacity with integrated supply chains, rapid prototyping capabilities, and cost advantages that enable both large-scale contracts and specialty orders.

The domestic market shows unprecedented growth, with collectible toys projected to exceed RMB 150 billion ($20.9 billion) in 2025, growing at 35% annually. Young adults drive demand, with Gen Z and Millennials comprising over 60% of users, while women represent 60.81% of consumers, creating cultural embedding through social platforms. Within Asia-Pacific’s 30% global market share ($91.8 billion, 6.6% CAGR to 2030), China’s leadership positions it as the fastest-growing regional market globally.

Global Market Diversification Beyond China

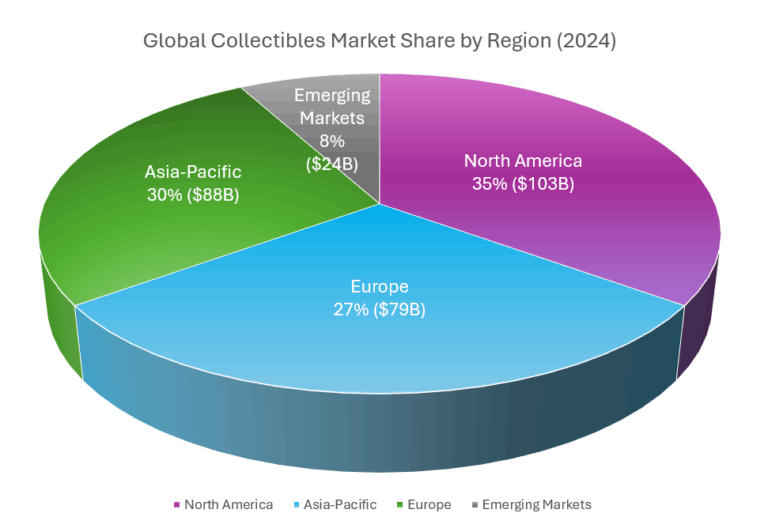

Despite China’s manufacturing dominance, global collectibles consumption maintains healthy geographic diversification, creating market resilience and varied growth opportunities across regions with distinct cultural preferences and spending patterns.

North American Strength: The United States represents the largest single country market at $85.2 billion in 2024, driven by strong adult collector demographics and established investment culture around sports cards, comic books, and entertainment memorabilia. Canada contributes an additional $12.8 billion, with particularly strong performance in hockey cards and vintage toys, together accounting for 35% of global spending.

European Markets: Europe reached $78.4 billion in 2024, with Germany ($18.2 billion), United Kingdom ($16.7 billion), and France ($14.1 billion) leading growth. European markets show strong preference for premium building sets, vintage toys, and culturally significant collectibles tied to local entertainment properties, representing 27% of global consumption.

Emerging Opportunities: Latin America and Middle East/Africa represent high-growth potential markets, valued at $24.6 billion and $18.9 billion respectively in 2024. These regions project 8.2% and 9.7% CAGR through 2030, driven by expanding middle classes, increased internet penetration, and growing cultural adoption of collecting as both hobby and investment, collectively representing 8% of current global spending with significant upside potential.

Market Outlook: The Orchestrated Future of Collecting

The global collectibles market, valued at $294.23 billion in 2023, is forecast to reach $422.56 billion by 2030 (CAGR 5.5%), with trading cards specifically projected to grow from $15.8 billion to $23.5 billion by 2030. Investment legitimacy accelerates through institutional recognition, with auction houses and wealth management firms now including collectibles in portfolio diversification strategies, driving 500–1000% appreciation on rare items.

Cross-generational appeal sustains growth as 76% of Millennial parents share collecting experiences with their children, creating dual purchase motivation. Both physical events and digital platforms will serve complementary roles—trade shows providing community experiences while digital platforms enable year-round engagement and authentication. The subscription-based toy market (12.1% CAGR, 40% adoption by 2025) demonstrates how orchestrated experiences create recurring revenue models.

The Next Collectibles Era

As collecting continues its evolution from niche hobby to mainstream investment-grade ecosystem, success will require seamless integration of emotional connection, social engagement, and financial value. Brands and platforms that master this orchestration—blending authentic experiences, robust technology, and multi-generational appeal—will shape the future of adult play and define the next era of the collectibles industry.

Market Sizing & Growth

Strategic Market Research, Stellar Market Research, Market Decipher: Global collectibles market sizing ($294.23B to $622.4B), CAGR projections (5.5% to 9.2%), and comprehensive industry forecasts (2024–2034)

DataIntello, Verified Market Reports, Grand View Research: Toy collectibles segment revenue ($12.5B to $20.3B by 2032, 5.7% CAGR) and Asia-Pacific market share analysis ($91.8B, 6.6% CAGR)

Circana, Business Research Insights: Adult toy purchasing data ($1.8B Q1 2025, 12% YoY), kidult market share (28–34% global toy sales), and demographic spending patterns

Category and Segment Trends

Strategic Market Research, Verified Market Reports: Trading cards market growth ($15.8B to $23.5B by 2030, 6.5% CAGR), professional grading premiums (5–100× multipliers), and segment forecasts

DataIntello, Grand View Research: Building sets CAGR (11.8%), collectible figures growth (5.7%), and licensed products market share (34% U.S. market)

EQL, Spielwarenmesse, CNN Business: Adult collector behavior analysis, Pokemon participation rates (19%), and nostalgia-driven purchasing trends

Regional Markets & Manufacturing

Grand View Research, Business Research Insights: Asia-Pacific dominance (36.48% global share), China’s collectibles growth (35% annually), and regional CAGR analysis (6.4%)

Circana, Retail Dive: North American consumption patterns ($85.2B U.S., $12.8B Canada), European market distribution, and emerging market projections (Latin America $24.6B, MEA $18.9B)

PR Newswire, Market Decipher: China manufacturing statistics (80% global exports, $48.36B in 2022), domestic market projections (RMB 150B by 2025)

Demographics & Consumer Behavior

Circana, CNN Business: Adult collector demographics (36.7 years average age), female participation growth (28% to 45%), and purchasing motivations (43% self-purchase rate)

EQL, Spielwarenmesse: Collector archetype analysis, spending patterns (Enthusiasts $4,800+, Casuals $2,000–3,000, Selectives $3,000–4,000), and social media engagement metrics

Grand View Research, Business Research Insights: Cross-generational trends (76% Millennial parent sharing), subscription market adoption (40% by 2025), and community engagement statistics

Technology & Authentication

Strategic Market Research, Stellar Market Research: Digital collectibles platform growth (Asia-Pacific $5.15B to $41.18B, 26.8% CAGR), blockchain integration trends, and AI grading accuracy (95%)

Business Research Insights, Verified Market Reports: NFT adoption rates, AR/VR integration impact (300% higher retention), and authentication service developments

Market Decipher, Grand View Research: Online marketplace expansion, social media influence quantification, and gamification effectiveness metrics