Despite an almost unprecedented period of global trade turbulence, as 2025 approaches its halfway point, HKTDC Research is adhering to its earlier forecast that Hong Kong’s export levels will rise by 3% for the year as a whole. This is in line with its expectation that this will be very much a year of two halves, with the first six months characterised by increased trade activity, followed by a sharp deceleration that could run into the first quarter of 2026.

This article provides the latest market insights for global buyers and suppliers conducting trade with Hong Kong businesses, as well as those concerned with the city’s overall business environment, to help you plan ahead.

Hong Kong Export Landscape - A Mild Drop in Local Exporters' Confidence

The unique factors that have shaped this year’s unusual trade development pattern stem, of course, from the drastic shift in US trade policy and, in particular, its wide deployment (or threat) of substantial tariffs on imports from many of its trading partners. While the trade negotiations continue, the heightened uncertainty has inevitably undermined consumer and business confidence.

The recently released HKTDC2Q25 Export Confidence Index indicates that Hong Kong exporters have not been immune to such concerns, as the Current Performance Index (49.6) and the Expectation Index (49.0) had fallen below the crucial watershed level of 50 for the first time in a year.

Hong Kong’s Unique Advantages Remain Strong

Despite the moderately downbeat findings of the 2Q25 Export Confidence Index, there are a number of encouraging underlying factors that should allow Hong Kong exporters to weather the US tariffs relatively unscathed whatever the outcome of the ongoing trade negotiations.

1. Relatively low exposure to the US market

Both Chinese Mainland and Hong Kong have relatively low exposure to the US market when compared with other economies. In 2024, US‑bound exports accounted for just 6.5% of Hong Kong’s total merchandise exports, while the corresponding Chinese Mainland figure was slightly higher at 14.7%.

2. Robust trade ties with other markets

Hong Kong’s enhanced trade connections with a number of key markets (notably the ASEAN bloc and the Middle East) are seen likely to buoy its current and future export performance. As an indication of this, between 2017 and 2024, although Hong Kong’s exports to the US decreased by 10.5%, this was more than compensated for by the increased exports to the ASEAN bloc (38.5%) and the Middle East (58.1%). This resulted in a 17.2% increase in total exports for the period.

3. Diversified sourcing networks

Over recent years, Hong Kong exporters and traders have prioritised diversifying their sourcing locations in line with the so‑called China+1 or China+N strategies. This approach was initiated during Trump’s first term in office in a bid to mitigate the impact of his initial tranche of Chinese Mainland‑targeted tariffs. As a consequence, many of Hong Kong’s US‑bound exports are now sourced from different locales than they were in 2017. In fact, in 2024, nearly half of Hong Kong’s US‑bound exports were originated from a variety of international sources, notably up on the comparable figure of 15% eight years ago (see Chart 1).

Mixed Performance Across Hong Kong’s Major Export Markets

When considering the performance of the city’s key export markets, a somewhat mixed picture emerges (see the table below). Reassuringly, exports to Chinese Mainland and the ASEAN bloc – the two most significant recipients of Hong Kong exports – continued to record double‑digit growth (18.1% and 24.8% yoy, respectively). By contrast, there was a notable slowdown in the growth of US‑destined exports, which decelerated to 3.1% yoy in the first four months. The trend is more notable when looking at the monthly trade figures, which show that Hong Kong’s exports to the US fell to a 1.0% yoy growth in April, after growing 11.4% yoy in March.

Global Export Outlook 2025

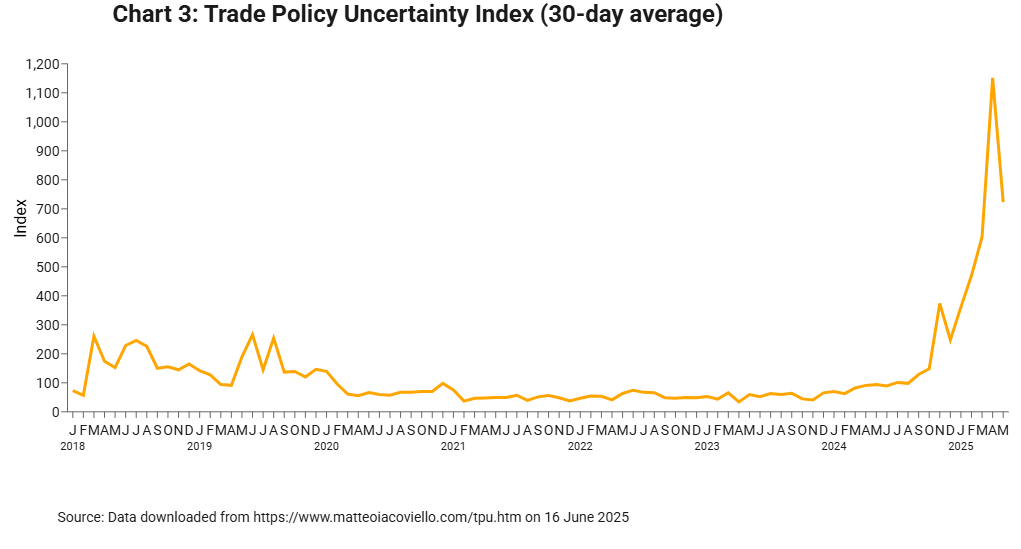

Looking beyond Hong Kong, it is clear that the above‑mentioned US trade policy developments have led to increased global trade uncertainty, an outcome reflected in the Trade Policy Uncertainty (TPU) Index1, a metric that has soared to unprecedent levels and remained elevated over recent months (see Chart 3).

Global trade uncertainty is expected to remain high at least until trade negotiations between the US and its trade partners reach some kind of conclusion. Of particular concern is whether or not the US could reach a trade agreement with all of its key trade partners during the 90‑day hiatus. This lack of clarity will inevitably result in businesses postponing operational decisions, reassessing supply chain strategies and committing to more comprehensive risk management initiatives. If such uncertainty persists, it could also impair the ability of businesses to commit to long‑term plans, which could also fundamentally reshape global trade patterns.

Overview of Export Outlook

All in all, the lingering uncertainties surrounding US trade policy represent a major challenge for the global economy in the near‑term. It is, however, worth bearing in mind that Hong Kong’s reduced export exposure to the US market, stronger trade ties with other markets, and its more diversified sourcing network are all helping to mitigate the direct impact of the US tariffs. At the same time, though, the indirect impact of tariff hikes – including supply‑chain disruptions and a global economic slowdown – may well prove to be a real challenge.

Hong Kong exporters also need to bear in mind the medium and longer‑term trends. The recent shift in US international trade policy has created heightened uncertainty for international trade and global business, while prompting global companies to rethink their supply chains and strategic business planning as they look to better serve the world’s two largest markets in these rapidly evolving circumstances.

1 The TPU index is constructed by staff in the International Finance Division of the Federal Reserve Board and measures media attention to news related to trade policy uncertainty. The index is scaled so that 100 indicates that 1% of news articles contain references to TPU.

Explore Full Research Findings

Access detailed insights, including supplementary analyses, via:

To gain the latest industry insights necessary to navigate the changing market, explore our e-Marketplace which is trusted by global buyers and suppliers since we are backed by the local statutory trade body.

Click the following banner to start your trade business with us: