To explore the latest sourcing behaviours, product trends, and future market prospects in the home products, fashion, and gifts industries, comprehensive surveys were conducted among 949 trade buyers attending Home InStyle, Fashion InStyle, and the Hong Kong Gifts & Premium Fair, organised by the Hong Kong Trade Development Council (HKTDC) in 2025.

Market Prospects

1. Cautious Optimism for Short- and Medium-Term Business Outlook

The survey revealed a neutral to slightly positive buyer sentiment for 2025. Among 949 buyers interviewed, nearly half anticipated an increase in overall sales in the short term (6–12 months), while the remainder expected stable performance. Looking ahead to the medium term (1–2 years), 55% of buyers expressed optimism about positive growth prospects.

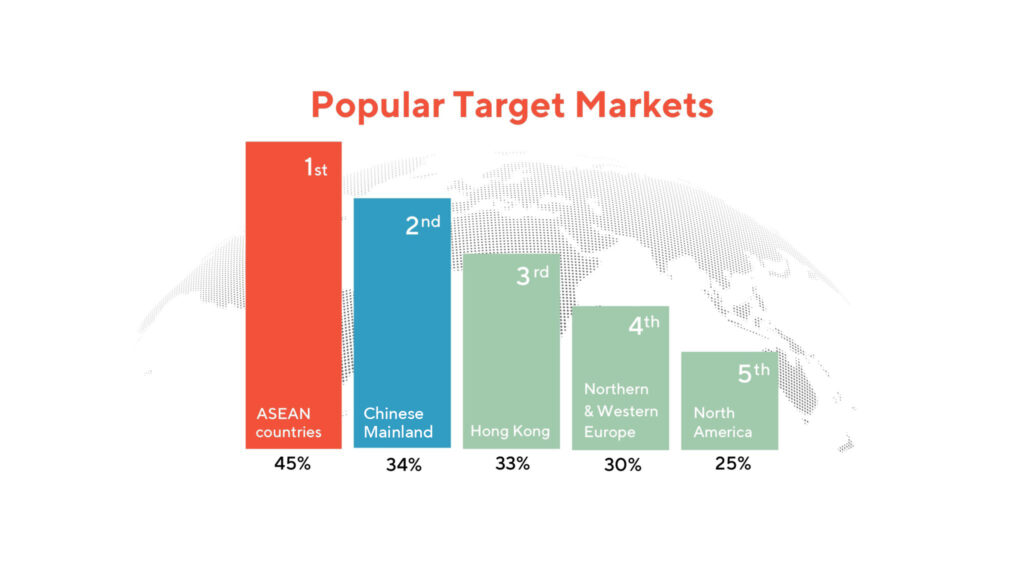

2. Greater Focus on Emerging Markets

In terms of target markets, nearly 50% of buyers identified ASEAN countries as key selling destinations, followed by Chinese Mainland, Hong Kong, Northern & Western Europe, and North America. This highlights the perceived growth potential in ASEAN markets.

Buyers also expressed optimism about the growth prospects of their target markets. More than half predicted promising sales prospects over the next two years, with Chinese Mainland leading the way at 74% of buyers forecasting growth, followed closely by ASEAN countries.

Sourcing Behaviours

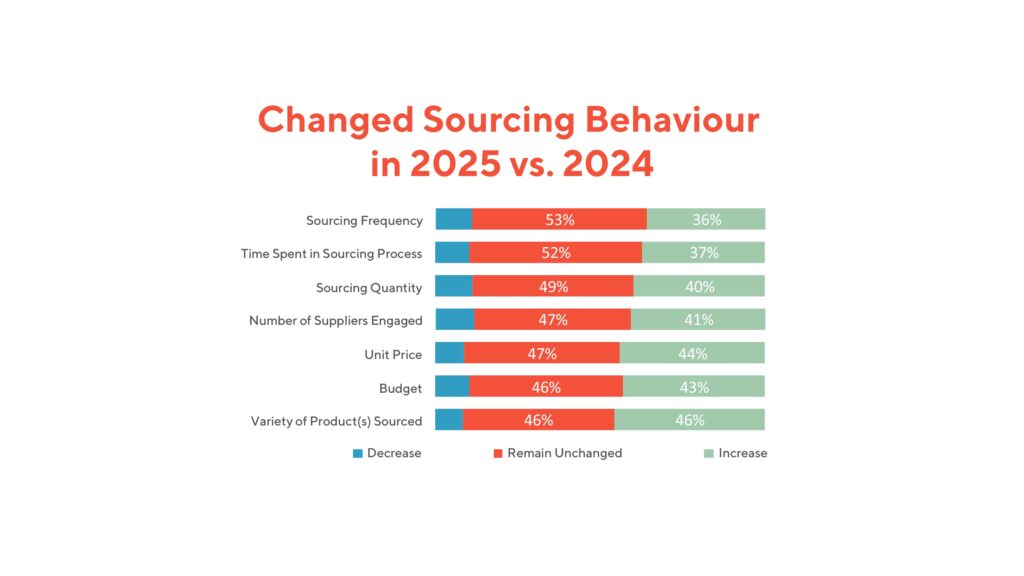

3. Buyers Maintain Sourcing Efforts

Around 50% of buyers reported maintaining the same sourcing levels as the previous year, while 40% expressed plans to increase efforts by expanding product variety, budgets, unit prices, and the number of suppliers engaged.

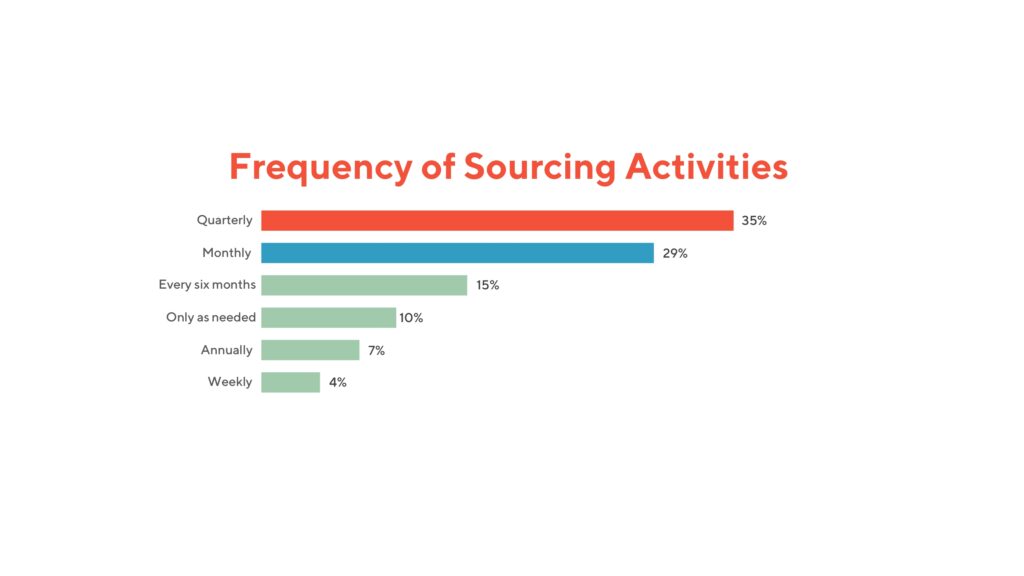

4. Majority Source Every Three Months or Less

Almost 68% of buyers reported sourcing as frequently as every three months or less, with 35% sourcing seasonally, 29% monthly and 4% weekly. This reflects buyers’ preference for shorter sourcing cycles to stay agile in fast-changing markets.

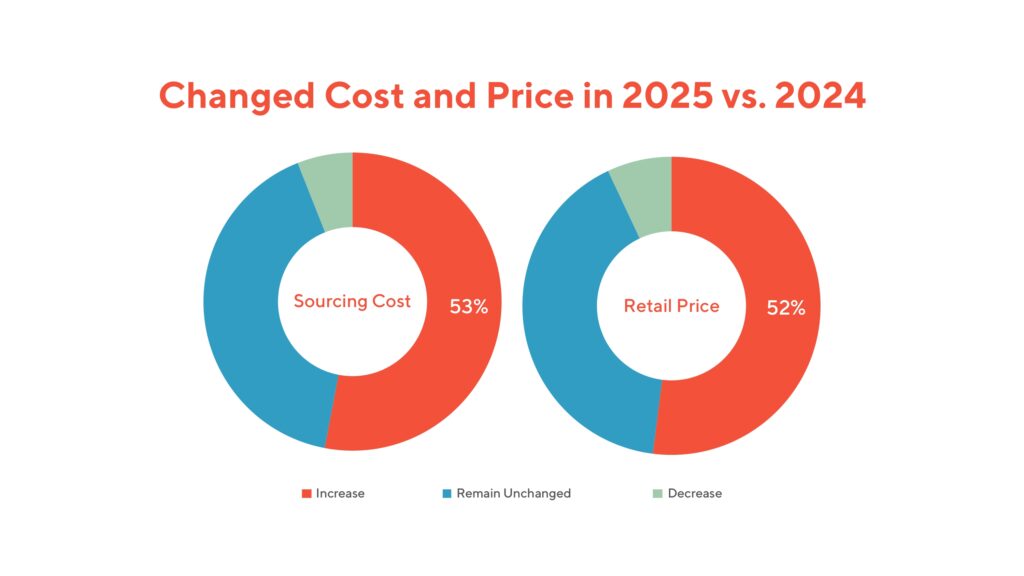

5. Balance Rising Sourcing Costs with Retail Price Adjustments

Rising sourcing costs were reported by 53% of buyers, with an equal proportion planning to increase retail prices to offset the impact. This suggests that buyers are under pressure from increasing operational costs, prompting adjustments to retail pricing to pass on costs to consumers.

Diversified Sourcing Channels

6. Major Objectives for Trade Fairs: Finding New Products and Suppliers

Nearly 70% of interviewed buyers attended the trade fairs to source new products, while 58% aimed to identify new suppliers. However, price sensitivity emerged as a key factor this year, with almost 40% of buyers prioritizing competitively priced products alongside new product and supplier discovery.

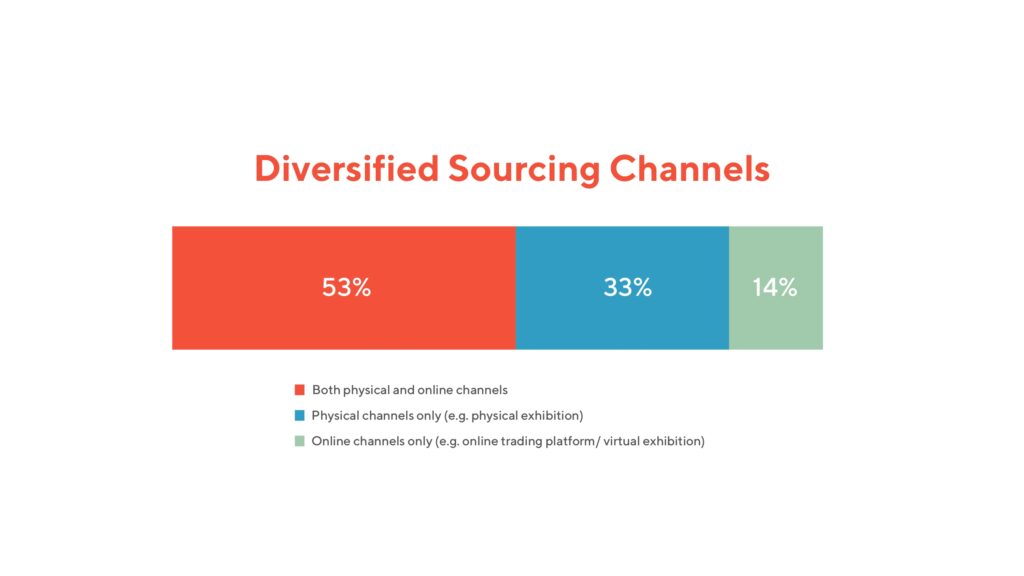

7. Buyers Adopt a Combination of Physical, Online, and Hybrid Sourcing Channels

While 33% of buyers identified physical trade fairs as indispensable, there is growing adoption of hybrid sourcing models. Notably, 53% of buyers utilized both online and physical channels, while 14% relied exclusively on online sourcing. This underscores the increasing popularity of O2O (online-to-offline) sourcing strategies, enabling 24/7 access to sourcing opportunities and complementing physical fairs, particularly during short sourcing cycles.

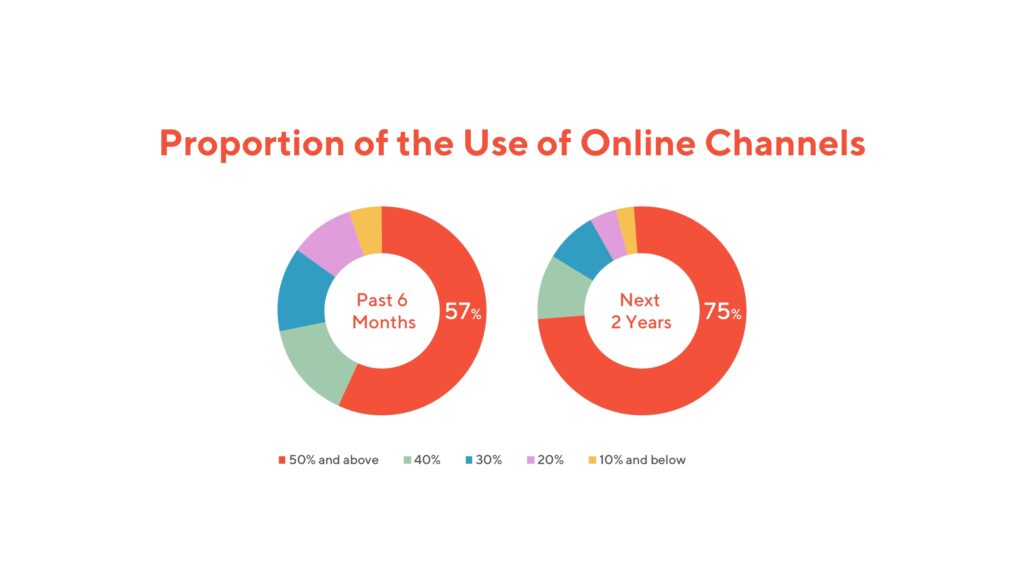

8. Buyers Plan to Increase Online Sourcing in the Future

Among buyers using hybrid channels, 57% reported conducting over half of their sourcing activities online in the past six months. Looking ahead, 75% expect more than half of their sourcing activities to shift online over the next two years. This indicates a growing preference for online sourcing channels, which complement traditional offline methods.

Upcoming Product Trends

The survey also interviewed buyers’ preferences across the home products, fashion, and gifts industries, revealing several emerging trends driven by smart technology, multi-functionality, and sustainability.

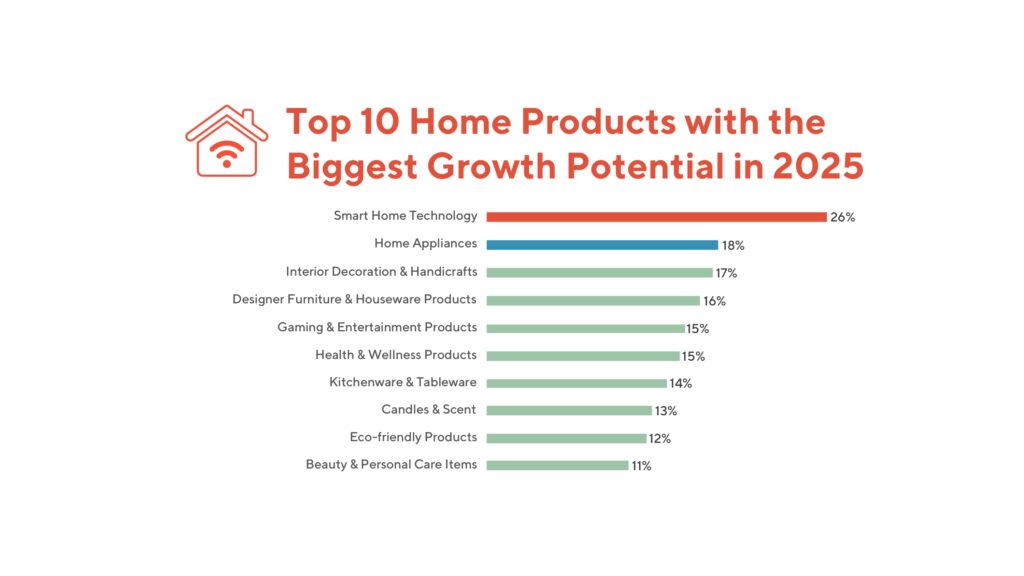

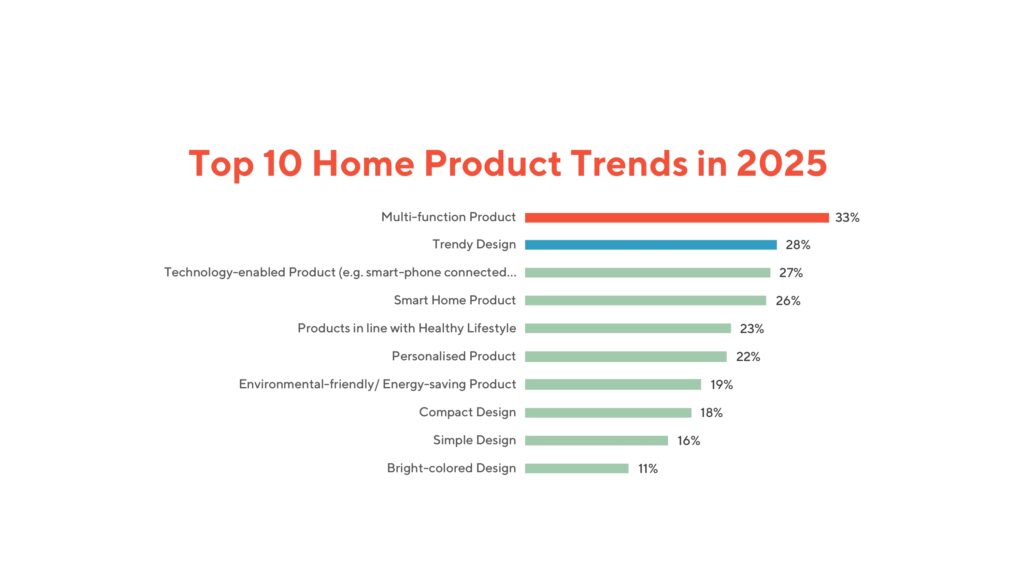

9. Smart Technology Drives Growth in Home Products

More than a quarter (26%) of buyers identified Smart Home Technology as having the greatest growth potential in the home products and furniture sector. This was followed by Home Appliances (18%) and Interior Decoration and Handicrafts (17%).

Key product trends for home product in 2025 included Multi-functionality (33%), Trendy Designs (28%), and Technology-enabled Products (27%).

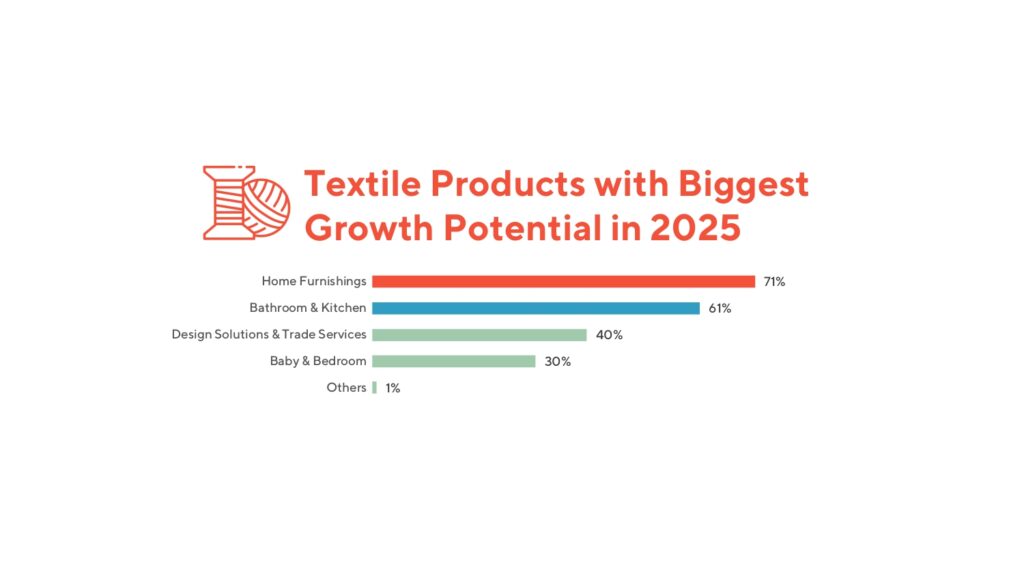

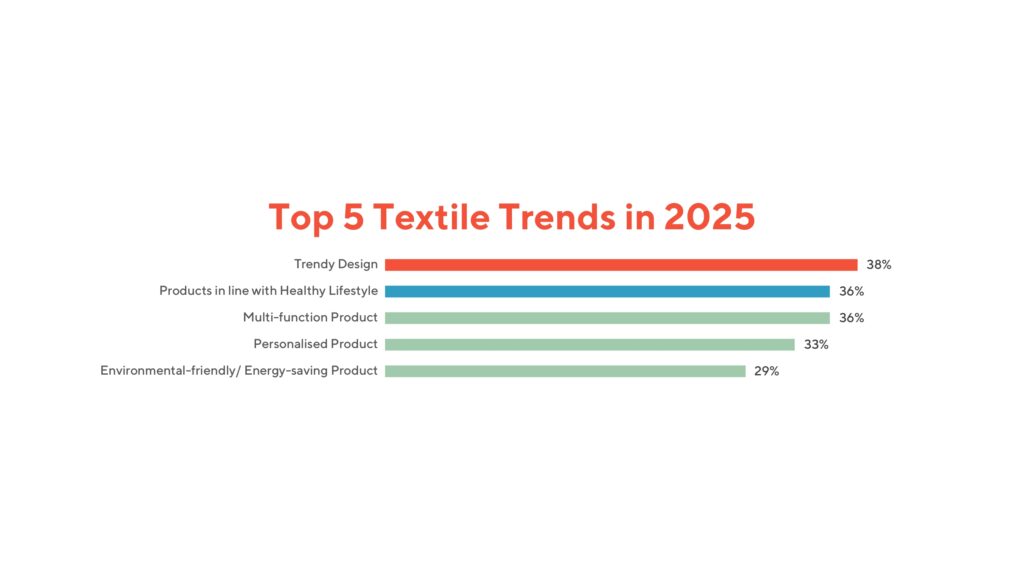

10. Home Furnishings Drive Continued Growth in the Textile Sector

In the textile sector, over 70% of buyers saw Home Furnishings as the most promising segment, followed by Bathroom and Kitchen Textiles (61%).

Popular textile trends included Trendy Designs (38%), Products in line with Healthy Lifestyles (36%), and Multi-function Product (36%).

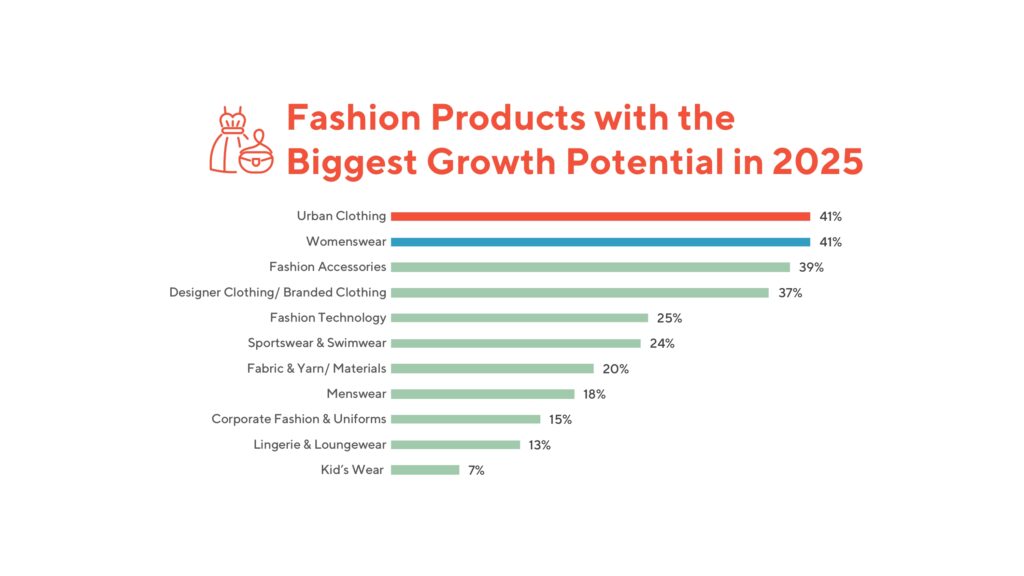

11. Urban Clothing and Womenswear Lead Fashion Trends

For fashion products, buyers’ preferences remained consistent with previous years, with Urban Clothing and Womenswear each receiving 41% of votes, followed by Fashion Accessories at 39%.

Trendy designs (59%) were deemed the most critical factor in facilitating business deals, followed by Competitive Pricing (51%) and Simple Designs (42%).

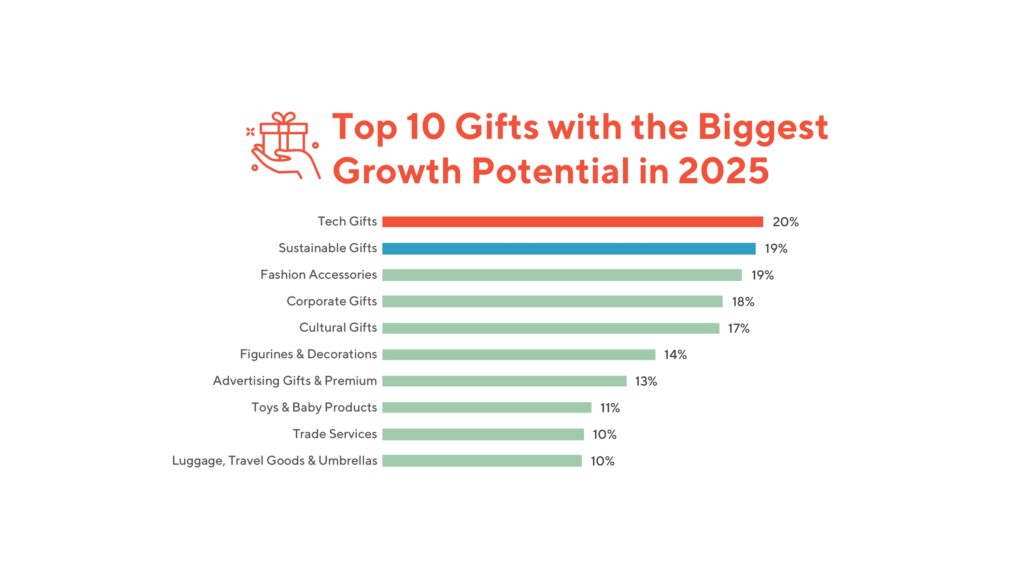

12. Gifts Industry Embraces Variety and Sustainability

In the gifts sector, buyers expressed interest in a range of categories, with Tech Gifts (20%) leading, followed by Sustainable Gifts and Fashion Accessories, each at 19%.

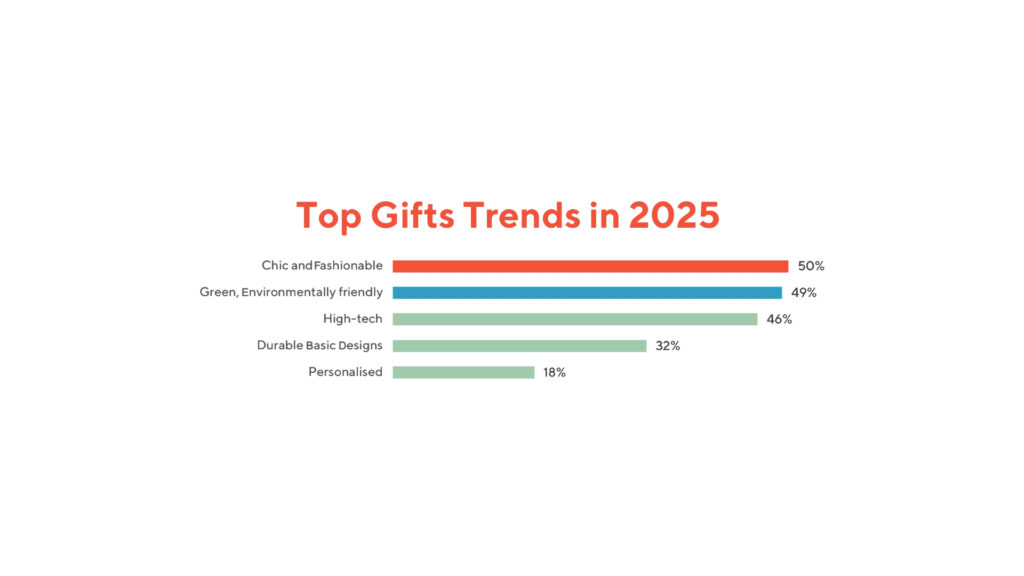

Trendy and sustainable products dominate the gifts industry, with 50% of buyers highlighting Chic and Fashionable Designs, and 49% identifying Green and Environmentally Friendly Products as key trends. High-tech Products (46%) also gained significant attention.

Summary

The 2025 surveys conducted at Home InStyle, Fashion InStyle, and the Hong Kong Gifts & Premium Fair revealed a cautiously optimistic outlook among buyers. Despite navigating rapidly changing business environment and economic uncertainties, buyers are moderately expanding their sourcing activities, with a more positive forecast for the medium to long term.

The continued adoption of O2O sourcing strategies is evident, with buyers complementing physical trade fair visits with increasing reliance on online sourcing channels. Emerging markets, particularly ASEAN countries, remain a primary focus for buyers.

The dynamic home products, fashion, and gifts sectors reflect strong market responsiveness, with trends such as smart technology, sustainability, and multi-functionality driving product innovation.

Don’t miss out on leveraging online sourcing opportunities! Visit hktdc.com Sourcing today to explore more:

Related posts:

Diverse Home, Fashion and Gifts Trends Revealed in Lifestyle Fair Surveys

Diverse Home, Fashion and Gifts Trends Revealed in Lifestyle Fair Surveys

The Future Is Green: Lifestyle Product Trends and Sourcing Behaviour at HKTDC Lifestyle Fairs

The Future Is Green: Lifestyle Product Trends and Sourcing Behaviour at HKTDC Lifestyle Fairs

The State of Fashion 2024-25: Embracing Sustainability, Diversity, and Global Opportunities

The State of Fashion 2024-25: Embracing Sustainability, Diversity, and Global Opportunities

Dressed to Impress: Top Fashion Trends of 2024-2025

Dressed to Impress: Top Fashion Trends of 2024-2025