The Urgent, Profitable Opportunity for Connected Child Buyers

The global children’s market is entering a dynamic new phase—where technology, creativity, and education intersect. The connected toys market is set to reach approximately US$14 billion in 2025, with the bulk of forecasts projecting US$35–37 billion by 2030 (CAGR 20–21%). This explosive growth covers EdTech, STEM kits, interactive play, and smart activewear. Educational toy revenues alone are on track for US$61.9 billion this year, and the kids’ learning app market is projected to grow from US$2.5 billion (2025) today to US$6.8-8.4 billion by 2033.

For B2B buyers, Q4 and the holiday period are decisive—35–45% of annual sales in toys, learning electronics, and digital children’s products occur in just a few months. With Q4 2025 set for robust, double-digit growth in Asia and ASEAN, being prepared with trending, high-turn inventory is more important than ever.

ASEAN as Growth Epicenter

ASEAN stands out as a critical hub for the global toy and learning market. The Southeast Asia toys & games market is valued at US$4.3 billion in 2024, forecast to reach US$45.5 billion by 2033 (CAGR 2.76%). Product momentum is intensifying in Q4 and holiday cycles, especially for interactive, educational, and smart toys. Notably, STEM toys in ASEAN now account for about 30% of global STEM toy value, projected at US$414 million in 2025. The region’s educational systems, digital integration, and fast-growing urban middle class ensure surging demand for learning-centric toys and Q4-preferred bundles.

The five largest ASEAN toy markets, by size and export leadership, are Indonesia, Malaysia, Thailand, Vietnam, and the Philippines. These economies are seeing double-digit sales growth in Q4 for connected and educational product lines, while also strengthening compliance and innovation for global export. Schools, parents, and institutional buyers are driving record procurement of platforms and kits with proven learning or smart/play integration, with regional makers responding quickly to global trends in AR/AI toys, STEAM, and sustainability.

Profitable Product Mix: Margins, Basket Size, and Global Trends

Globally, “connected child” categories—especially educational toys, smart toys, EdTech, and kids’ wearables—average 25–35% profit margins, outperforming mass-market toy and seasonal non-tech goods. Successful B2B buyers and platforms boost these returns by creating product bundles, exclusive holiday editions, and classroom-ready combos, which have been shown to lift Q4 order value by 22% and significantly drive repeat purchasing. Emerging market data also shows a clear trend: the fastest sellers in Q4 are interactive, educational, and smart products, with Asia-Pacific and ASEAN’s margins often on par with North America and Western Europe due to rising disposable incomes and willingness to pay for innovation.

Why You Can't Wait

It’s not just about market size—it’s about how quickly the landscape is shifting and the high stakes of early engagement. In 2025, over 74% of parents in Asia-Pacific report investing in digital learning, health, and play for their children. The online parenting education sector is growing at 12.2% CAGR through 2033, fueling sustained growth in the connected child ecosystem. Global connected toys sales are forecast to rise from US$10.57 billion in 2024 to US$22.48 billion by 2033 (nearly 9% CAGR).

Most crucially, Q4 2025 is projected to see over 15% YoY global growth in connected child product sales, with persistent strength forecast for Q1 and Q2 2026—the “long tail” of post-holiday upgrades and education investments. ASEAN and Asia are engines for this wave, fueled by premiumization, single-child households, and digital learning adoption.

Decisive action now means locking in supply, securing margin, and claiming leadership before competition peaks.

Understanding the Connected Child—And Category Differences

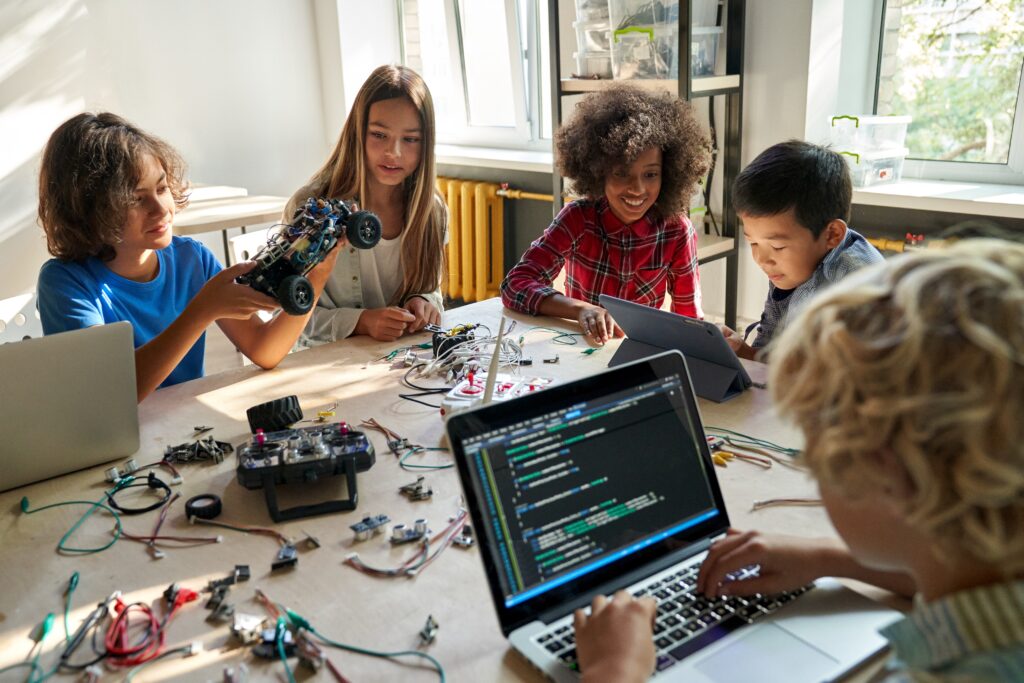

The “Connected Child”: Today’s children engage, learn, and play with products embedded with technology, interactivity, and educational content. They expect seamless transitions between play, school, and everyday smart products—demanding a new approach from every serious buyer.

STEM Toys & Kits: Skill-building sets blending science, tech, engineering, math, and logic play (coding robots, science kits, engineering games).

EdTech Devices: Digital/AI-powered learning, from tablets and reading pens to adaptive apps (in school or at home).

Smart Toys & Interactive Play: Intelligent, sensor-enabled, or app-linked—and always evolving. These are today’s AR plush, interactive robots, and personalized digital games.

Children’s Activewear & Tech-Integrated Gear: Modern kids’ sportswear and apparel, with high-performance fabrics and wearable tech (UV, safety, fitness, digital accessories).

Success Strategies: 2025's Hottest Connected Child Segments

As families become more tech-savvy, and demand for educational and interactive play increases, the most competitive buyers are those who combine real consumer insights with agile procurement. Here’s where the data is pointing for this year and beyond:

1. STEM Toys & Kits

The global STEM toys market was estimated at US$1.2 billion in 2024 and will reach US$1.83 billion by 2030 (CAGR 7.2%), with Asia-Pacific set for an even higher 7.8% CAGR. STEM toys for the 3–8 year market will outpace older age groups, growing at 7.7% CAGR, reflecting the demand for coding robots, building sets, AR/STEAM kits, and “learning by doing” in early childhood. Major drivers include the integration of arts for holistic development (STEAM), government reforms promoting STEM schools, and the rise of accredited/curated toy subscriptions, which are now standard for aspirational middle-class parents.

The channel landscape is also shifting: 42% of STEM toy sales now come from hypermarkets and supermarkets, with online channels like e-commerce and subscription platforms growing nearly 7.9% CAGR, broadening reach and impulse purchasing potential. Accredited brands (like LEGO, Mattel, Hasbro) still command volume, but new players that leverage digital/STEAM and offer subscription models are gaining global traction.

Procurement Tips

- Target modular, multi-pack, or STEM subscription lines for ongoing sales and classroom or home learning bundles.

- Seek accredited SKUs with third-party endorsements, and screen for eco-friendly and licensed product options.

- Watch for regionally localized kits that connect with school systems or parent organizations.

Explore top-rated STEM kits and educational toys for next-generation learners.

2. EdTech Learning Devices

Global EdTech is projected to top US$348 billion by 2030, with Southeast Asia outpacing global averages in domestic and institutional adoption. Key drivers include smart learning pens, AI reading systems, multifunctional tablets, and hybrid home-school apps. In both ASEAN and China, bilingual tools and platforms that support blended or digital-first curricula are top priorities.

Parental willingness to invest continues rising—74% of digital parents in Asia-Pacific now purchase “edutainment” gadgets as must-haves for pre-school and primary years. Segment leaders are adding AI-powered diagnostic tools and parental dashboards so families can track progress and adapt learning routines. The fastest-growing SKUs deliver not just content, but also multi-language and curriculum alignment options for Q4 and back-to-school spikes.

Procurement Tips

- Prioritize suppliers offering aftersales support, content/content renewal options, and local compliance.

- Test for proven language support and school compatibility, preferably with reviews or pilot outcome data.

- Bundle device purchases with platform access, parental guides, and warranty support.

Discover the latest EdTech devices redefining education for connected children.

3. Smart Toys & Interactive Play

The global market for connected and smart toys is set to surge at 24.3% CAGR, reaching a projected US$66.9 billion by 2030. In Asia, smart toys now routinely account for one-third or more of all Q4 toy sales, with parental focus shifting to voice-enhanced companions, AR/VR playsets, sensor-driven games, and connected plush. Key growth is coming from toys that use machine learning, personalization, and safe data analytics to build child engagement—and from lines that develop skills beyond screen time.

Personalization and adaptive learning are now top differentiators for online/physical retail buyers, while safety, regular digital content refresh, and family engagement modes are often decisive factors in B2B orders.

Procurement Tips

- Select suppliers with real-time software/app updates, strong records in child privacy, and scalable product ages/features.

- Match SKUs to both holiday and post-Q4 cycles—many buyers restock or refresh with new “skill packs” in Q1/Q2.

- Consider licensing or co-branding to tie in with local hit franchises or educational providers.

Browse groundbreaking smart toys and interactive products built for future-ready kids.

4. Children’s Activewear & Tech-Integrated Gear

Global children’s activewear is on track to exceed US$63.5 billion by 2028, but the fastest gains are being seen in lines that blend functional fabrics (UV, antibacterial) with smart tags, wearable trackers, and app integrations. In Asia-Pacific and ASEAN, sports participation, “athleisure” fashion, and health-conscious parenting are pushing up market share for tech apparel, smart accessories, and seasonal Q4/back-to-school promotions.

Both mass-market and premium buyers are increasing basket value by bundling apparel with smart wristbands, digital tags, or AR fitness/learning integration, which drive repeat purchasing and cross-category engagement post-holiday.

Procurement Tips

- Confirm partners can provide quick-turn fashion drops, full family sizing, and regulatory certifications (OEKO-TEX, UPF).

- Align launches with key sports seasons and educational campaigns for maximum sell-through.

- Test pilot bundles that pair clothing with tech-enabled accessories (e.g., activity trackers), doubling perceived value and building loyalty.

Uncover kids’ activewear and smart gear for the connected generation’s holiday demand.

Your Next Move: Capturing the Connected Child Revolution

Q4 2025 marks more than just another holiday season—it’s your gateway to sustained leadership in the connected child market. The transformation is undeniable: digital-native children, tech-savvy parents, and innovation-driven education are converging to create unprecedented opportunities for forward-thinking buyers.

Looking ahead to 2026, the landscape promises even greater rewards. AI-powered personalization, sustainable design, and cross-category integration will define the next wave of connected child products. Early movers who secure strong supplier relationships now will be positioned to capitalize on emerging trends like voice-enhanced learning companions, AR-integrated play experiences, and health-monitoring wearables that seamlessly blend into children’s daily lives.

The choice is clear: act now to secure your competitive advantage, or watch from the sidelines as agile competitors claim market share in one of retail’s fastest-growing segments. The connected child revolution isn’t coming—it’s here.

Ready to lead the future of play and learning? Browse HERE for the latest connected child products, connect with suppliers, and send enquiries to secure your Q4 inventory and 2026 growth strategy.

Bonus for Suppliers:

With the surge in global demand for educational toys, smart learning tools, and connected play, buyers are actively searching for agile, innovation-driven partners. If you specialize in EdTech, STEM, or interactive products, this is your moment to stand out and capture new business. Become a supplier on hktdc.com Sourcing and connect with engaged buyers who are sourcing now for Q4 and beyond.

Market Sizing & Growth

Grand View Research, PS Market Research, 360iResearch, Mordor Intelligence: Connected toys market sizing and CAGR (2024–2030 forecasts)

Research and Markets, Fortune Business Insights: Educational toys market revenue and growth

IMARC Group, PR Newswire, Statista: Southeast Asia and ASEAN toys & games market size, YoY growth, and industry segmentation

Cognitive Market Research: Asia-Pacific and ASEAN STEM toys market share, value, and CAGR

Category and Segment Trends

DataIntelo, Verified Market Reports: Kids’ learning app/licensed app market size and projections

Future Market Insights, Trend Bible, Kind+Jugend ASEAN, HKTDC Sourcing: Macro category trends, seasonal and Q4 drivers, procurement insights

Lurie Children’s, OECD: Digital parenting and investment, online education trends Asia-Pacific

Sourcing, Margins & Sales Behavior

Business Research Insights, The Toy Association: Margin benchmarks, Q4 basket uplift, and buyer best practices

MarketResearchSoutheastAsia, Statista: Asia/ASEAN digital adoption and Q4/holiday peak buying behavior

Innovation & Outlook

Markets & Markets, Allied Market Research: Smart/AR toys, AI integration, privacy trends

IMARC Group, LinkedIn Industry Highlights: Q4 product trends, cross-category comparisons, long-term growth outlooks